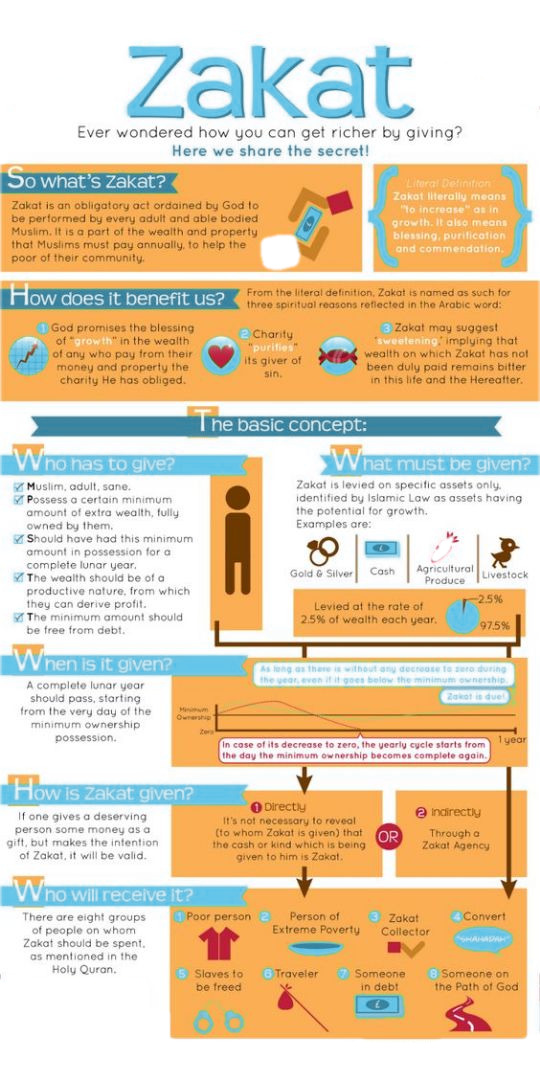

Don’t forget to pay Zakat this Ramadan! Don’t know about Ramadan Zakat? So, let’s understand it today! Ramzan zakat is a portion of one’s wealth that is paid to deserving people at the end of Ramadan fasting so the needy and poor community can also celebrate the blessings of ‘Eid.

Islam is the natural religion that teaches its believers to help the needy peoples of the community by paying zakat. In Islam Zakat is obligatory to pay just like fasting and prayer offering. It has particular significance in Islam. It’s an obligation for a person who has a particular amount of assets of all forms like land, Gold and Silver jewelry, and money to pay Zakat.

The significance of the ‘Zakat’ word

Zakat is the word of the Arabic language that means “growth”. It also means purification. But purification of what? As fasting is the purification of the soul from evil, the same as zakat is the purification of your assets. God (Allah) also says about it in the Quran:

“Take Sadaqah (alms) from their wealth in order to purify them and sanctify them with it…” (7:103)

Assets that are Zakat-Able (Rules)

- Jewelry like gold, silver, and any other precious jewelry items.

- Money that you have lent to someone.

- Stock or shares.

- Cash in bank accounts.

- Pension.

- A house where you are not living.

- Any type of property item which you have kept to earn a profit.

How to Calculate Ramadan Zakat?

We are here to guide you on How to Calculate Zakat.

- First, calculate Nisab which is 39198 PKR for this year as per the Pakistan Government.

- Determine the net worth of zakat by subtracting liabilities from zakat-able assets.

- Compare the net worth of Zakat with Nisab.

- If the net worth of Zakat is more than zakat, then you are obligated to pay 2.5% of the net worth of Zakah.

- If the net worth is less than Nisab then you are not obligated to pay Zakat.

Let’s suppose the net worth of your zakat-able assets is 40,000 PKR and Nisab is 39198 so you are obligated to pay zakah which will be 1000 PKR(2.5% of 40000PKR)

Still, confused about Zakat Calculation? Don’t worry! our Ramadan Zakat Calculator will also help you to calculate it with 100% accuracy.

How much and to whom Zakat should be given?

Zakat is 2.5% of all assets on which zakat is applied after paying the particular liabilities of the year. Jewelry item like Gold and silver are also zakat-able and their worth should be included to calculate totals. It is paid annually at the base of the lunar calendar.

Islam is the complete code of life and guides everything through verses of the Quran and Hadith. Quran tells very clearly that who is eligible for it. The basic purpose of zakat is to give a hand to needy families by giving them zakat. People who are old, disabled, or not able to fulfill their expenses are eligible for it.

As it is also explained in Surah At_tauba:

“Zakat is for the poor, and the needy and those who are employed to administer and collect it, and the new converts, and for those who are in bondage, and in debt and service of the cause of God, and for the wayfarers, a duty ordained by God, and God is the All-Knowing, the Wise.”

Importance of Zakat according to the Quran

Allah(SWT) says in Quran-e-Majeed:

“Surely they who believe and do good deeds and keep up prayer and pay the poor-rate (Zakat) they shall have their reward from their Lord, and they shall have no fear, nor shall they grieve.” [Al-Quran 2:277]

Look at these words from God that How Allah (SWT) will be happy and reward someone who thinks for the needy people of the community by offering Zakat from his assets.

Here are some other verses of Quran-e-Hakeem that explain the importance of this obligation:

“If you give alms openly, it is well, and if you hide it and give it to the poor, it is better for you; and this will do away with some of your evil deeds, and Allah is aware of what you do.” [Al-Quran 2:271]

Zakat is a way to contribute your share for the welfare of society. There are specific laws to find out the zakat share of your property. Must follow these Islamic rules and laws and deliver it to the person who deserves it. Once the state was responsible to collect and distribute zakat to needy people and there was a particular organization for it, but now people prefer to deliver it on their own.

Frequently Asked Questions (FAQ’s) Related to Zakat

Q: Is Zakat Due?

Ans: If your assets worth more than the Nisab of the current year then it is obligated to pay off Zakat

Q: Can we pay Zakat to relatives?

Ans: Yes! You can, but if they deserve it.

Q: Is Zakat paid only in Ramadan?

Ans: No, You can pay Zakat in any month.

Q: How much is Zakat Percentage?

Ans: It is 2.5% on all assets.